Key Takeaways

Port growth is good news – but it also raises the operational standard. In a higher-tempo SoCal import environment, forwarders win by planning for exception management, not just routine execution. The biggest risk isn’t “congestion” in general – it’s the micro-failures that create rolled freight, missed pickups, and customer escalations.

Key numbers from the Port of Long Beach outlook:

2025 throughput: 9.8M containers

2050 forecast: 20M containers

Annual cargo value: $300B

Planned rail investment: $3.2B

China share shift: 70% → 60%

The Port of Long Beach cargo volume in 2025 reached a record level – a headline that matters not only because it signals growth, but because of the conditions under which it happened. The year was shaped by volatility: tariff pressure, uneven shipper behavior, and sharp month-to-month swings in container flow. Yet Long Beach absorbed that turbulence and still finished in record territory.

Now, under new CEO Noel Hacegaba, the port is preparing for a long runway of expansion. The message is clear: Southern California is not entering a quieter phase of logistics. It’s entering a faster, higher-stakes one – where the cost of delay compounds quickly, and execution matters more than optimism.

For freight forwarders managing sensitive cargo, time-critical timelines, and customer expectations that don’t allow excuses, this is a shift worth taking seriously. This signals a higher-tempo SoCal import environment where planning cycles compress and execution gaps become more expensive.

In that environment, the forwarders who stay ahead won’t be the ones with the most optimistic schedules – they’ll be the ones with the strongest recovery playbook and the right execution partners already lined up, as reflected in the Port of Long Beach cargo statistics.

Port of Long Beach cargo record: what happened in 2025

A record year at the Port of Long Beach might sound like a simple story of strong demand. But the more important detail is what made the record possible: a market that was reacting in real time.

Throughout 2025, shippers adjusted shipping schedules to get ahead of changing tariff conditions. Instead of predictable volume patterns, the port saw a system that expanded and contracted quickly, with importers front-loading cargo when policy changes threatened to raise costs. This behavior doesn’t just increase throughput – it compresses planning windows and turns routine moves into exception-driven operations.

Operationally, that typically means more last-minute appointment pressure, more equipment imbalance, and more cases where the original delivery plan has to be reworked midstream. For the port, breaking records under those conditions suggests operational strength. For the freight ecosystem around it, it signals something else: volatility is no longer an occasional disruption. It’s becoming part of the baseline.

And when volatility becomes baseline, congestion risk doesn’t disappear – it becomes more uneven. Some weeks run smoothly. Other weeks feel like every container is urgent. That’s the real “Port of Long Beach cargo record” story: it wasn’t achieved in calm waters.

Why 2025 wasn’t a normal growth year

In a normal growth year, volume increases gradually and systems adapt through planning. In 2025, the market behaved differently. The port experienced a pattern logistics teams know too well: sudden surges, followed by slowdowns, followed by another surge.

That volatility wasn’t subtle. Container volume fell from 867,493 in April to 639,160 in May, then jumped to 944,232 by July — the kind of swing that compresses planning cycles for drayage and delivery and increases the number of shipments that become time-sensitive by default.

That kind of movement doesn’t just strain terminals – it strains everything connected to them: drayage scheduling, warehouse receiving, appointment windows, chassis availability, and driver capacity, putting Southern California drayage capacity under immediate pressure.

It also changes the psychology of the network. Every time there’s uncertainty, teams move faster and hold less slack. Everyone tries to “get ahead,” which creates new pressure on capacity.

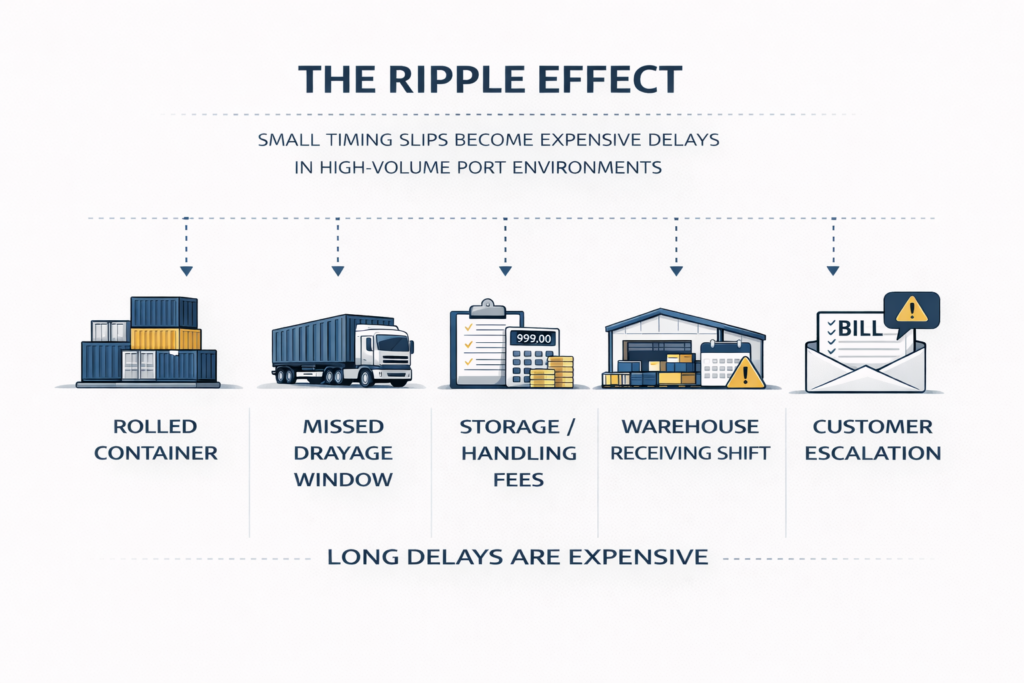

This is exactly where the Long Beach port congestion risk becomes less about headlines and more about micro-failures: missed windows, rolled containers, and the domino effect that follows when one part of the chain loses its timing.

For freight forwarders, the risk shows up when cargo misses pickup, when a container rolls to the next available window, and when storage and handling charges start stacking while customers demand updated ETAs. These aren’t abstract problems – they show up as customer escalations, tight cutoffs, and shipments that go from “planned” to “at risk” in a single day.

What doubling throughput means for freight forwarders

Forecasts project the Port of Long Beach container volume will reach the equivalent of 20 million containers by 2050, up from 9.8 million last year. That scale changes the economics of reliability and investments.

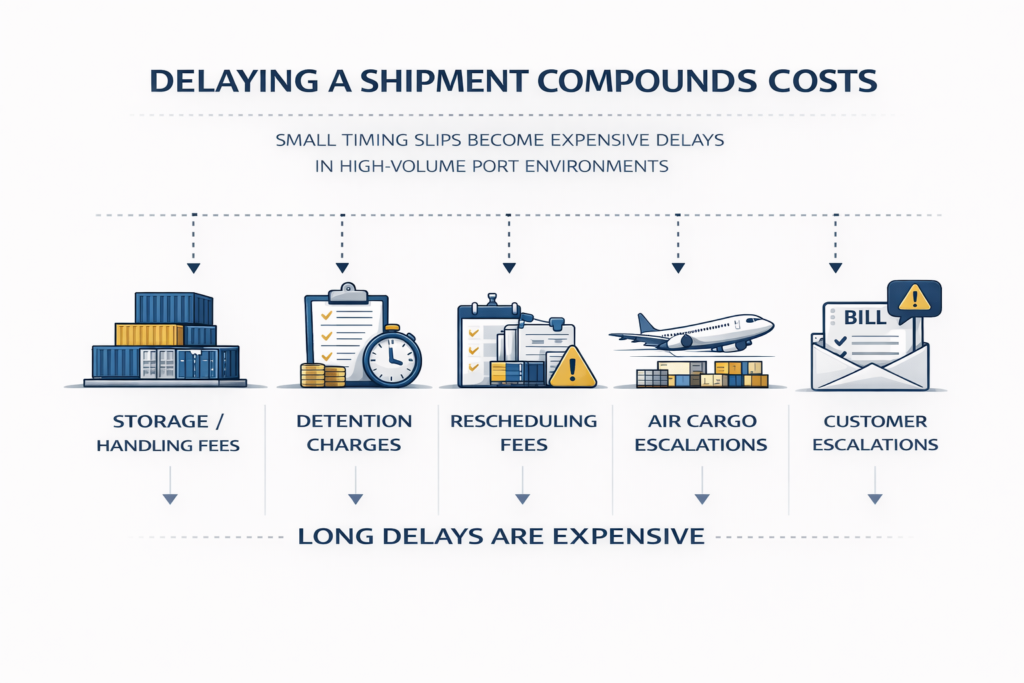

When throughput doubles, the network doesn’t simply get bigger. It becomes more sensitive. The margin for error shrinks, because more freight is moving through tighter systems. In high-throughput environments, small delays become expensive delays – and expensive delays become reputational damage.

This is especially true for freight forwarders because your role is rarely just “book the move.” It’s to protect the outcome. You’re managing the point where operational execution meets customer expectations.

Forwarders don’t measure success by movement alone. They measure success by whether the shipment stays stable: whether cargo clears on time, whether the pickup happens before storage begins stacking, whether delivery timing holds, whether the customer stays calm, and whether the plan survives contact with reality.

Long Beach leadership has also emphasized investment in infrastructure and efficiency – including major inland rail connectivity investments designed to move containers out faster. That matters. But even as rail expands, trucking remains the shock absorber of the port ecosystem.

When timing breaks – when a pickup window slips, a container rolls, or receiving changes last-minute – the solution is rarely theoretical. It’s operational, and it depends on having execution support that can move fast without adding friction.

How to reduce risk on SoCal imports in 2026

For freight forwarders, the operational takeaway is simple: the faster the port complex runs, the less tolerance there is for missed pickups, rolled freight, and delayed delivery windows. Growth increases the number of shipments that become time-sensitive by default – because the cost of being late stacks quickly through storage, handling, and downstream service penalties.

So the question isn’t “Will SoCal imports stay busy?” The question is: How do you reduce exposure when import container delivery delays in California hit your shipment?

The answer is not one magic tool. It’s a posture: planning for recovery, not just planning for the best case.

In 2026, forwarders can reduce risk by building execution options into the move before the shipment becomes urgent – identifying recovery-capable partners, allowing buffers where possible, and prioritizing fast communication when the plan shifts. When cargo misses pickup, when a container rolls, or when a warehouse receiving window changes, the forwarder who wins is the one who can reroute quickly and keep the customer informed with certainty instead of guesswork.

This is also where specialized support matters. Not every shipment needs a hero. But the shipments that do – the ones that are sensitive, regulated, time-critical, or escalation-prone – require partners who can execute exceptions without adding friction.

Where LAX Freight fits in this shift

LAX Freight helps freight forwarders in Southern California recover and execute sensitive shipments when the plan breaks – not just move freight when everything is running smoothly.

In real operations, forwarders don’t need generic coverage. They need execution that matches the failure mode:

- Time-critical freight needs rapid-response pickup and delivery to prevent penalties, rolled cargo, and customer escalations.

- Air cargo moves depend on fast airport recovery and clean handoffs to the next mile when timing is tight.

- Volatile port flow requires drayage support that can absorb missed windows and shifting terminal conditions without creating new delays.

- Hazmat and regulated freight demands compliant execution that keeps urgency from turning into risk.

- Cross-border moves succeed or fail based on coordination – reducing surprises, not adding them.

LAX Freight is the partner forwarders call when a shipment can’t afford to slip.

A real-world example

A forwarder can plan a clean move on paper – but when a receiving window changes late, or a pickup slips into the next available slot, that shipment instantly becomes an exception. In those moments, the forwarder isn’t looking for another status update. They’re looking for a partner who can execute quickly, stabilize the timeline, and reduce the chance of compounding costs.

That’s the role LAX Freight is built to support: forwarder operations under pressure.

FAQ: Port of Long Beach 2025 Record & Freight Forwarders

Q1. What was the Port of Long Beach cargo volume in 2025?

A: The Port of Long Beach handled a record 9.8 million containers in 2025.

Q2. What is the forecast for Port of Long Beach container volume by 2050?

A: Long-term forecasts project the port will handle approximately 20 million containers by 2050.

Q3. Why did Port of Long Beach cargo volumes swing so much in 2025?

A: Much of the volatility came from shippers front-loading cargo ahead of tariff changes, creating uneven month-to-month surges and slowdowns.

Q4. How does port volatility affect freight forwarders operationally?

A: Volatility compresses planning cycles and increases exception risk – including missed pickups, rolled containers, and delayed delivery windows.

Q5. What’s the biggest forwarder risk in a high-volume SoCal import environment?

A: The biggest risk isn’t “congestion” in general – it’s micro-failures that trigger storage and handling costs, disrupt warehouse receiving, and escalate into customer service issues.

Q6. What should freight forwarders do to reduce SoCal import risk in 2026?

A: Forwarders should plan for exception management early by building recovery options into the move, maintaining fast communication, and working with partners who can execute quickly when timing shifts.

Final takeaway: Long Beach growth raises the standard for reliability

The Port of Long Beach record year in 2025 isn’t just a milestone. It’s a preview of what the next era of Southern California logistics will demand: higher tempo, tighter tolerance for delay, and greater consequences when freight drifts into exception territory.

For freight forwarders, this is the moment to treat recovery capability as a core part of the operating model – not an emergency measure. Because as volume rises, reliability becomes less about what happens when everything goes right, and more about how quickly you can stabilize a shipment when it doesn’t.

If you want a useful next step (not a sales call), build a simple internal checklist: what’s your recovery plan when the pickup slips, the container rolls, or the customer escalates? That question will matter more as SoCal volume keeps rising.

About LAX Freight: LAX Freight provides time-critical freight execution across Southern California, supporting forwarders with drayage, air freight support, hazmat moves, and cross-border shipping (Canada, Mexico) – built for exception-driven operations.